Home > 1099-B Match

Seamlessly drag and drop your Form 1099-B PDF from any brokerage account(s), and let TraderFyles do the heavy lifting. With our cloud-based system, generating an Automated Schedule D/Form 8949 report is just a click away. Whether you have one account or multiple, get accurate, IRS-compliant results every time. Dive into details with our Error Reconciliation, ensuring that every transaction is spot-on. Financial clarity has never been this effortless.

To get started, upload an unlimited of 1099-B PDFs from any brokerage account. After you click ‘Generate’, TraderFyles will extract the transaction data from the uploaded PDF files, run calculations.

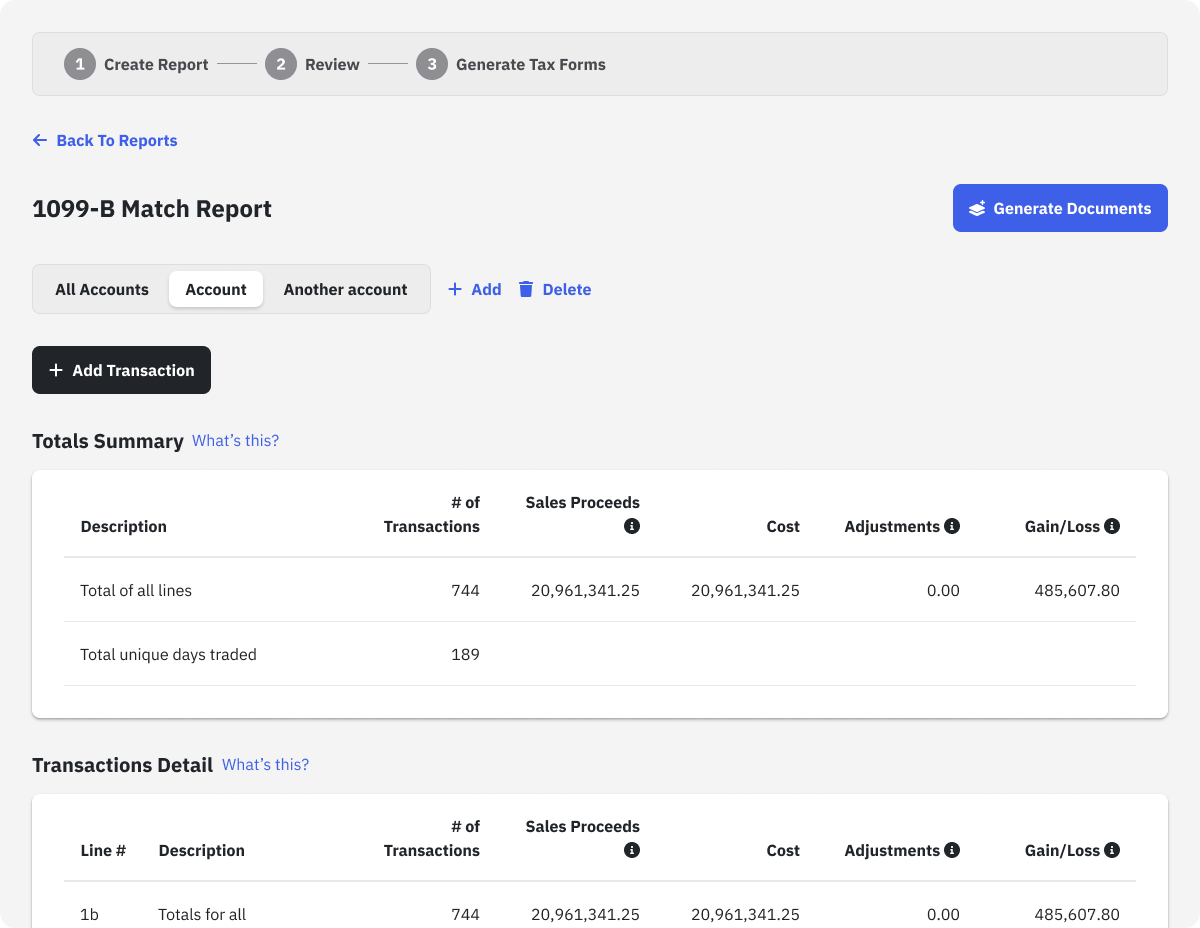

Our cloud-based software then previews your number of transactions, total sales proceeds, cost, adjustments, and gain/loss in an easy-to-read table. The software will flag any errors and prompt you to input missing transactions to balance your tax report.

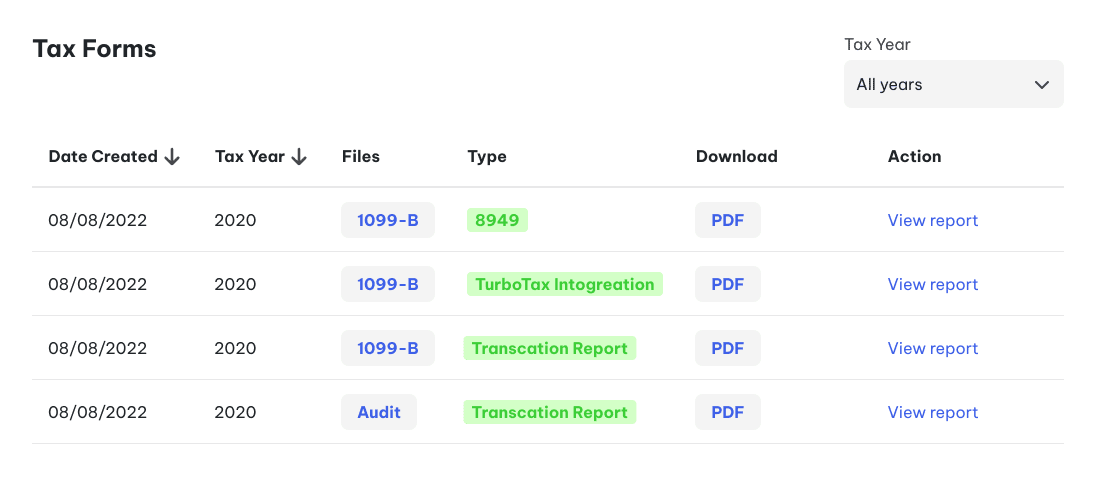

Finally, generate IRS Form 8949 & Schedule D, IRS Form 4797, and/or transaction history if you want to perform an independent capital gain/loss calculation using Audit My Broker. Download and attach the documents to your taxes. You’re done!

After you click ‘Generate’, TraderFyles will read the data in the uploaded PDF files, run calculations, and compile the data in an easy-to-read table.

Our cloud-based system with flag any errors and prompt you to input missing transactions to balance your tax report.

TraderFyles creates accurate, IRS-ready tax forms in seconds. Download and attach the documents to your tax filing. You’re done!

TraderFyles is the most recommended software of 2023 for trader tax reporting

and more!