TraderFyles is cloud-based, powerful, easy-to-use trader tax reporting software for all.

Unveiling 1099-B Match & Audit My Broker for Trader Tax Reporting

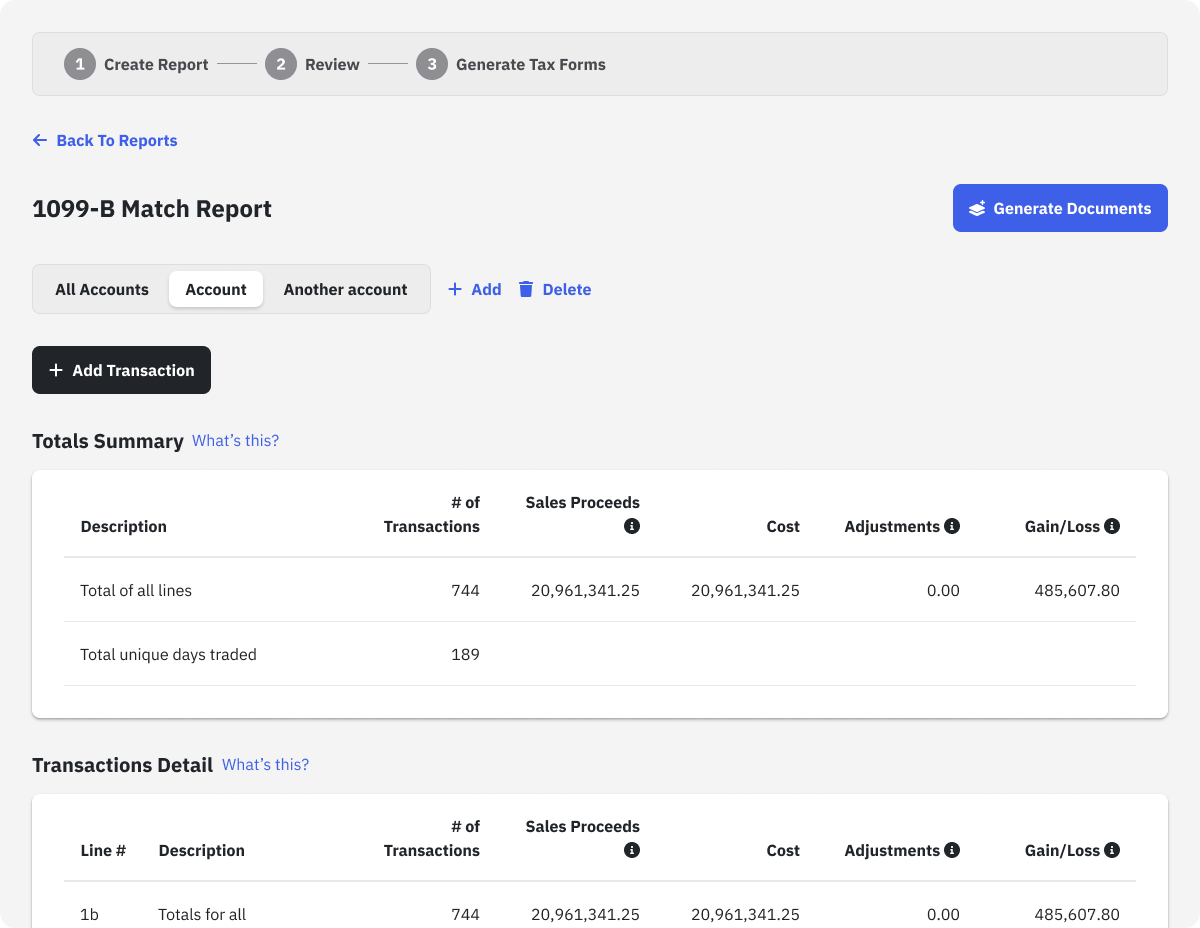

Effortlessly automate your Schedule D/Form 8949 Reporting. Simply drag and drop as many Form 1099-B PDF files as you have from any brokerage, generate the report, and if it’s all good, click on ‘Generate Docuements’.

Need adjustments? Our Error Reconciliation lets you add any missing transactions, ensuring accuracy.

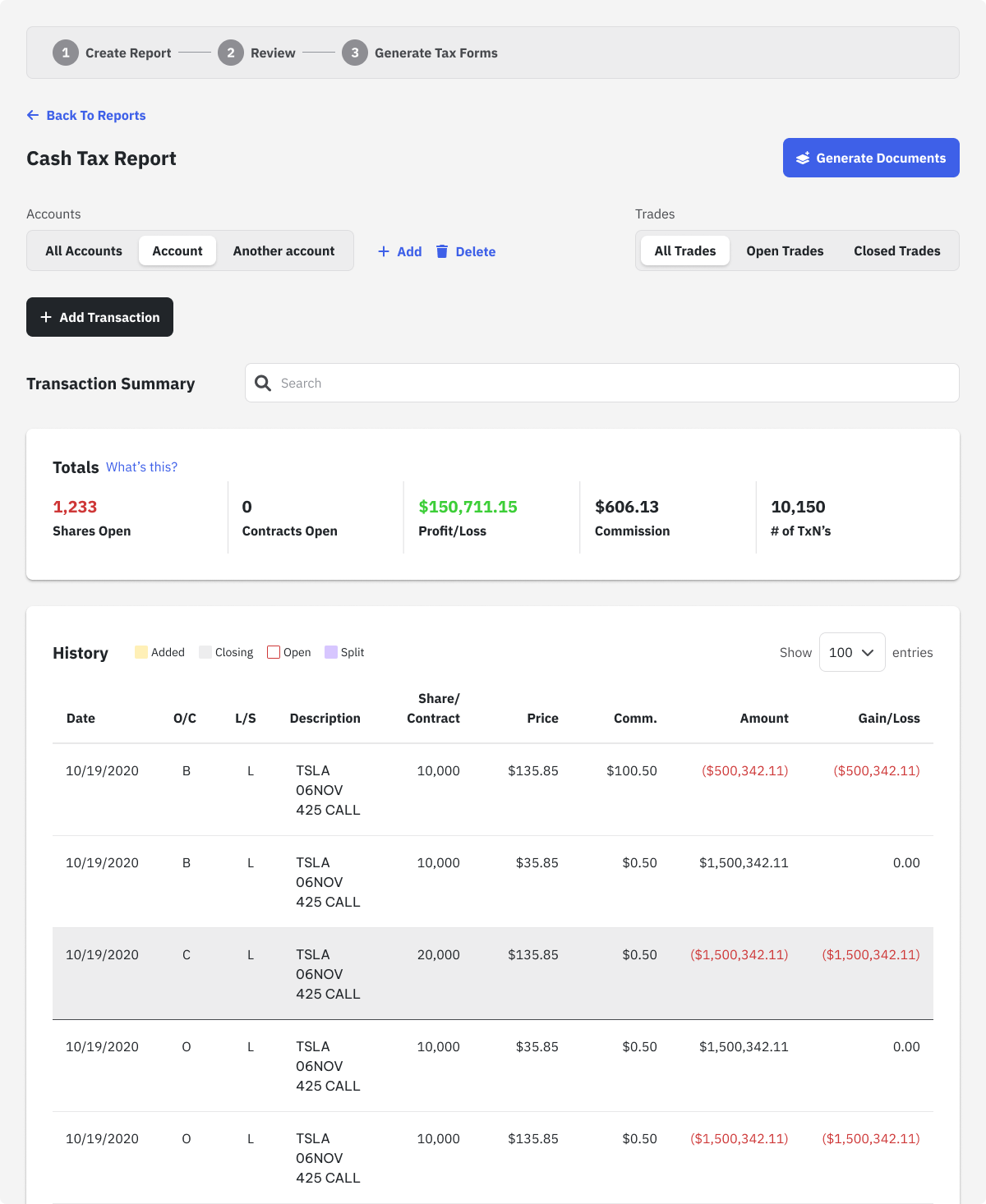

Whether you’re using cash or Sec. 475 Marked-to-market accounting methods, this tool performs an accurate independent calculation of your profit/losses.. From flagging wash sales to accurate reporting based on those sales, get the confidence in your trader tax reporting that you deserve.

…and more

TraderFyles is fully cloud-based and accessible on any device. All you need is an internet connection. Our software is recognized as highly innovative software for trader tax reporting.

and more!

Traders and tax professionals use our cloud-based software to manage tax reporting, wash sales, and streamline their tax filing. You should too.

Manage wash sales effectively and avoid unnecessary surprises

IRS-ready tax forms in minutes.

Easily incorporate your cryptocurrency transactions.

Find and fix errors in your transaction history.

Say goodbye to manual calculations.

Add as many brokerage accounts as you have.

Everything for traders, plus…

Empower your trader tax reporting with our tailored plans.

Perfect for New Traders

Ideal for Regular Traders

Optimized for Frequent Traders

The Ultimate Choice for Professional Traders

Perfect for New Traders

Tax Professionals can enhance their subscription with our tiered plans for additional credits at a discounted rate