Home > For Tax Professionals

We’ve meticulously designed our tax software for tax professionals to simplify the tax reporting process while ensuring robust, accurate results.

At TraderFyles, we understand the unique demands faced by Tax Professionals, especially when it comes to managing the complex tax landscape of 1099-B clients. We’ve meticulously designed our tax software for tax professionals to simplify the tax reporting process while ensuring robust, accurate results with features like 1099-B Match and Audit My Broker. Embrace the effortless, yet comprehensive tax reporting journey that TraderFyles offers.

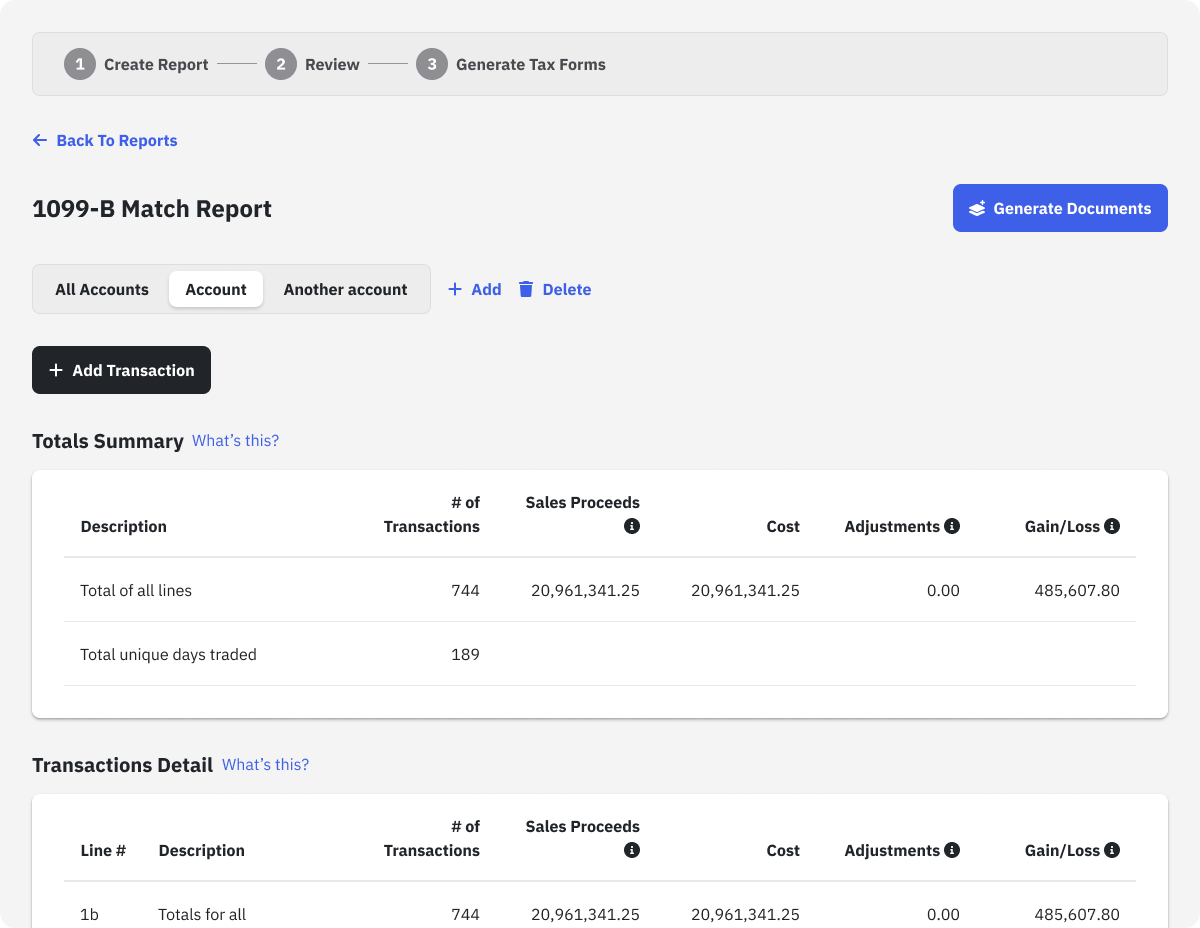

1099-B Match is tailored to seamlessly blend into your workflow. This feature allows for straightforward importing of 1099-B PDFs from various brokerage accounts, eliminating manual data entry and the associated errors. Experience the peace of mind that comes with automated, accurate Schedule D/Form 8949 tax form generation at your fingertips.

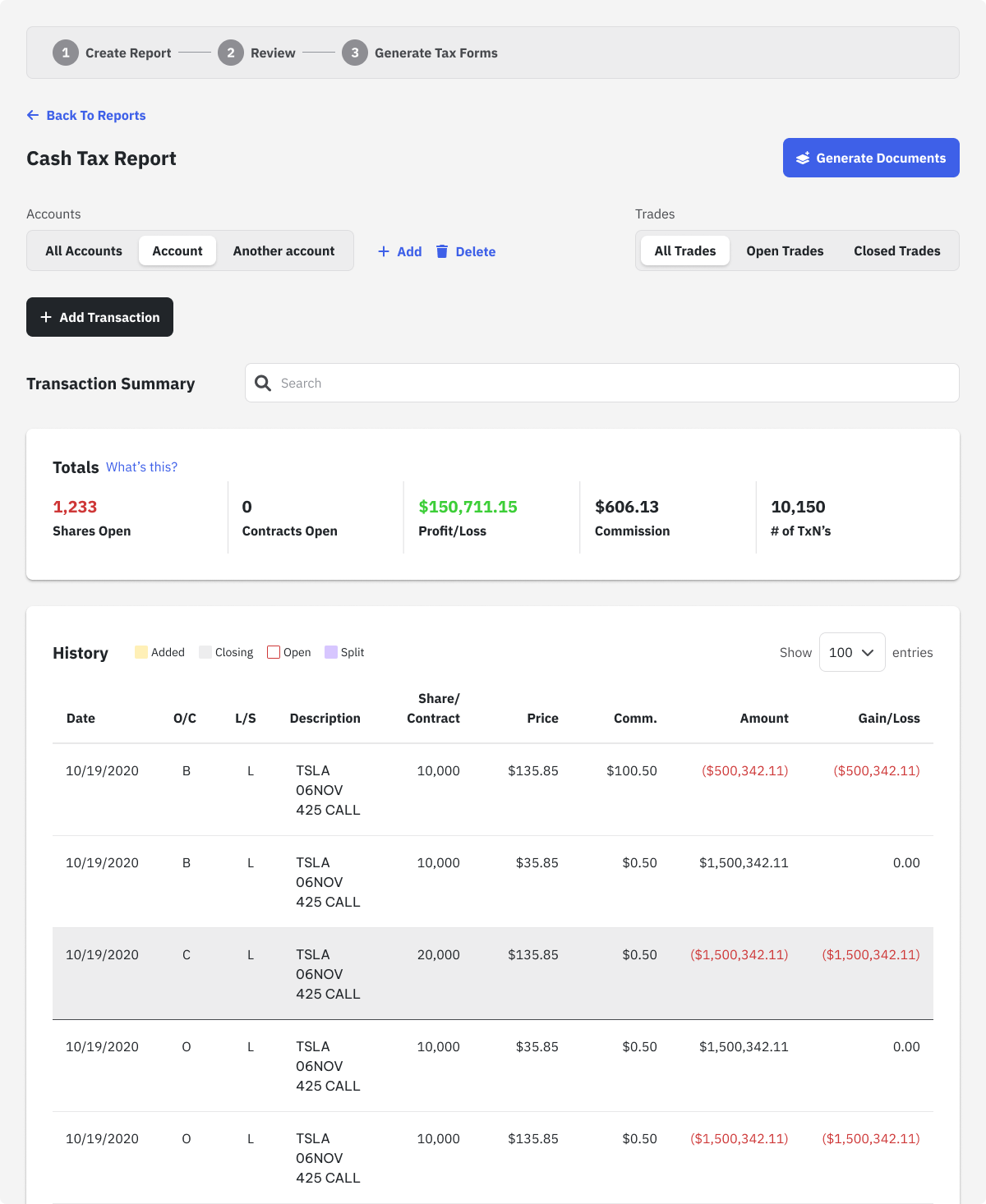

Audit My Broker provides an exceptionally accurate, independent verification of gains/losses for your clients’. Import their trading history and let TraderFyles do the rest. It’s more than just a reconciliation tool; it’s your pathway to informed, confident tax reporting.

Use Audit My Broker report from TraderFyles to perform an accurate, independent verification of profits/losses for your clients to ensure they are reporting to correct taxable income.

Empower your trader tax reporting with our tailored plans.

Perfect for New Traders

Tax Professionals can enhance their subscription with our tiered plans for additional credits at a discounted rate