Have More Than 10,000 Transactions on TurboTax? Here’s The Fix

As an active trader, dealing with taxes can be a challenging task, especially when you have a high volume of transactions. Traditional tax software like

As an active trader, dealing with taxes can be a challenging task, especially when you have a high volume of transactions. Traditional tax software like

Navigating Form 8949: A Comprehensive Guide for Tax Professionals Every tax season brings with it a unique set of challenges for tax professionals, and one

Active day traders play an essential role in the market’s dynamism, carrying out frequent trades that respond to short-term price movements. This daily financial juggling

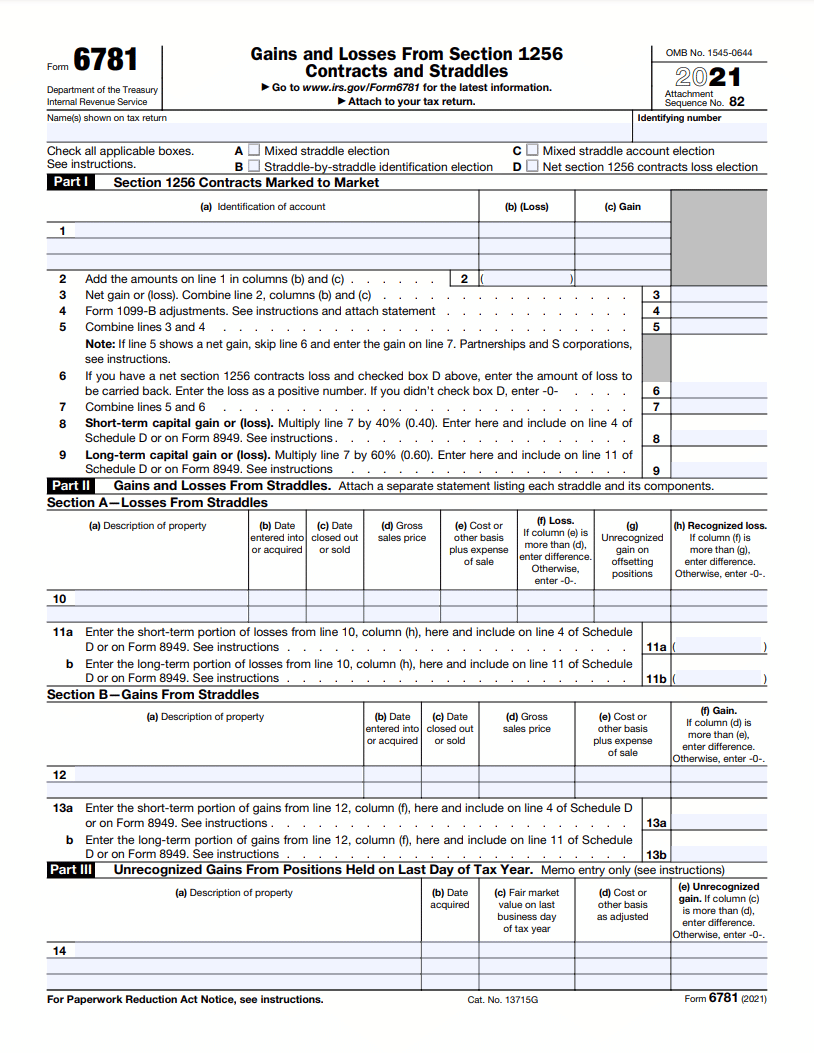

If you are a trader of index options, you should know the benefits of Section 1256 contracts. These are tax-advantaged contracts that can provide you

You’ve been day trading for a while, and you’ve been pretty successful at it. You’re thinking about taking the plunge and going full-time. But there’s

A wash sale is a transaction where an investor sells an asset at a loss and then repurchases the same or a “substantially identical” asset

When it comes to day trading, one of the most important things to understand is how to calculate your capital gains tax. This will ensure

If you’re like most people, the world of IRAs and investment accounts can be confusing. There are so many different options, and it’s hard to

A wash sale is when an investor sells a security at a loss and then buys the same or substantially similar security within 30 days.

Individual Retirement Accounts (IRAs) and 401(k)s are two of the most popular retirement savings plans available. Both have rules and regulations and their own benefits

The IRS defines a wash sale as “a sale of a security at a loss and the purchase of a substantially identical security 30 days

The 1099-B is an IRS form used to report proceeds from broker and barter exchange transactions and covered securities transactions. Day traders use this form

Many people want to know how stock traders report taxes. The answer may seem complicated, but it doesn’t have to be. Here is a brief

Are you a day trader? You may be eligible for Trader Tax Status (TTS) if so. TTS is a special tax designation that can save you a lot of money come tax time. This blog post will take a quick look at what TTS is and how it can benefit you.

Take control of your taxes.