You’ve been day trading for a while, and you’ve been pretty successful at it. You’re thinking about taking the plunge and going full-time. But there’s one thing holding you back: taxes. More specifically, you’re worried about how to pay fewer taxes as a day trader. So, you ask how to qualify for trader tax status (TTS).

What is Trader Tax Status (TTS)?

Trader tax status is a designation given to taxpayers who meet certain criteria set forth by the IRS. TTS comes with a number of benefits, chief among them being the ability to deduct business expenses from your taxes. This includes computer equipment, office space, education, and travel.

How to Qualify for Trader Tax Status

Now that we know what TTS is and its benefits, let’s talk about how to qualify.

To qualify for TTS, you must meet a set of criteria that is based on IRS Tax Topic 429:

- You must derive a majority of your income from trading.

- You must be considered a “trader in securities” by the IRS.

The first criterion is relatively straightforward. If more than 50% of your income comes from trading, you should have no problem meeting that criteria. The second criterion is a bit more complicated and is where most people run into trouble.

How to Qualify as a Trader in Securities

To be considered a “trader in securities” by the IRS, you must meet the following criteria:

- You must have business expenses customary to an active day trader. If you are executing your trading business, you will incur many expenses just in the ordinary course of business. And these are reasonable and necessary to execute. For example, if you’re a short seller, you may have a hard-to-borrow interest or locate fees. If you have a brokerage account, you might pay for data feeds. You might subscribe to a newswire service like Benzinga Pro or scanners like TradeIdeas. These are all expenses customary to an active day trader.

- You must have equipment used for day trading. Day trading equipment needs to be equipment used in the execution of your trading and could include items such as:

- Computer with multiple monitors

- Laptop

- High-speed internet connection

- Day trading software platform

- You must spend enough time in the market as a trader. This means that trading cannot simply be a hobby; it must be your primary source of income. Regarding how much of your income needs to come from trading, the IRS has said that traders should expect to spend at least 500 hours trading per year trading on qualifying for TTS.

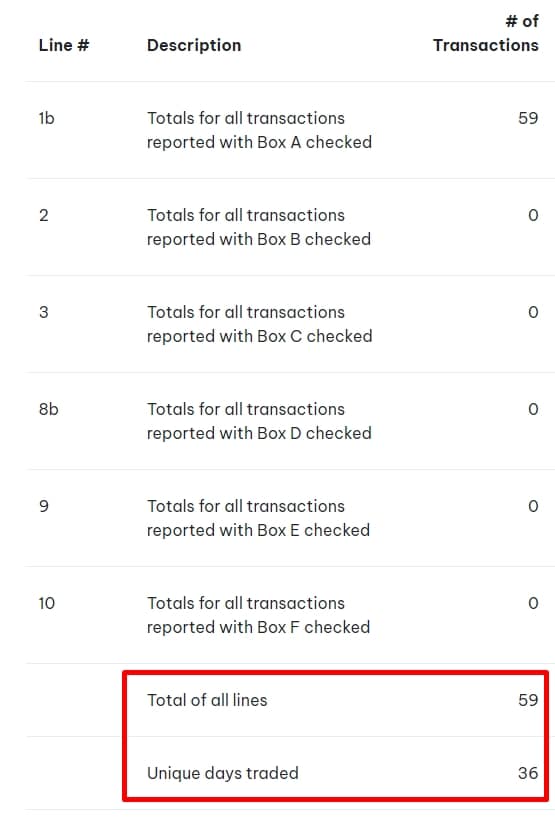

- You must trade actively. You cannot simply buy and hold a stock for years; you must be an active trader, constantly buying and selling securities. The IRS has never provided explicit guidance on these questions, but they have offered some general guidelines. For example, a good benchmark is placing at least 720 trades during a tax year. A trade is defined as a buy or a sell. Active day traders can meet this criterion quickly.

- You must trade frequently and regularly. To qualify for TTS, you must trade frequently. This is, by far, the most challenging criterion to hit. But what does “frequently” mean, exactly? The stock market is open 252 days per year. The IRS states that you must actively trade in at least 189 days of the 252 days. This gives you 75 days you can afford to miss for vacation, sick time, or any other personal time off.

TraderFyles Can Help

TraderFyles has a built-in metric to determine how many trades you placed and how many days you traded, the two most difficult criteria to meet, in the tax year. All you have to do is upload your 1099-B into our 1099-B Match or upload your trade history into Audit My Broker and let the software do the rest. Sign up today and start taking advantage of trader tax status!

Bottom Line

Qualifying for trader tax status can save you a lot of money come tax time—but it’s not easy. You need to meet these five criteria to qualify for trader tax status. If you can check all of those boxes, then congratulations—you are well on your way to reaping the many benefits that come with TTS!

Of course, these are just general guidelines—the IRS could audit your taxes and determine that you don’t meet the requirements for TTS even if you think you do. So it’s always best to consult with a tax professional before attempting to claim TTS on your taxes.

Here is an excellent video from Brian Rivera, CPA, discussing how to qualify for trader tax status. Check it out.