Home > Features

Are you a trader or tax professional? Choose your path and see how TraderFyles can help you…

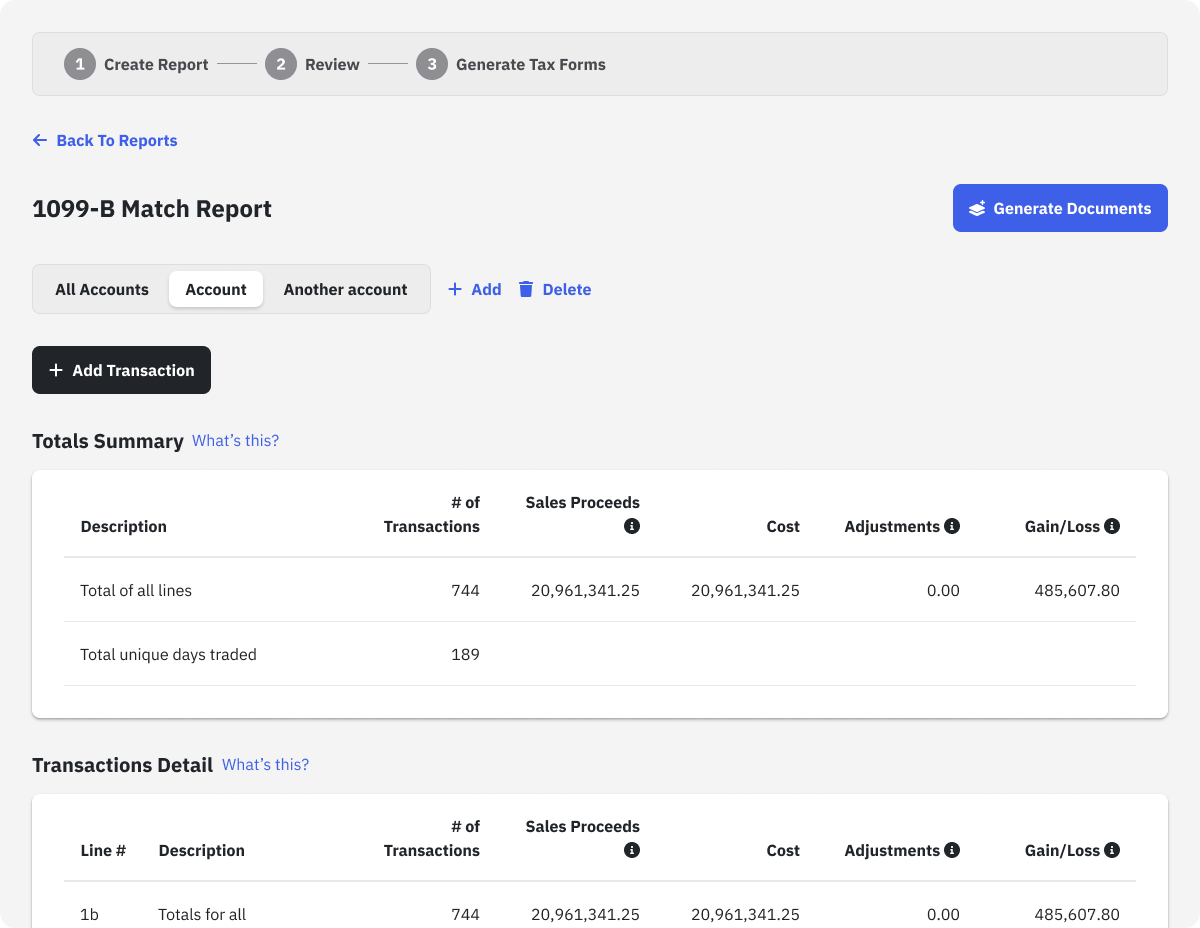

Optimize Your Trading Tax Reporting with 1099-B Match & Audit My Broker

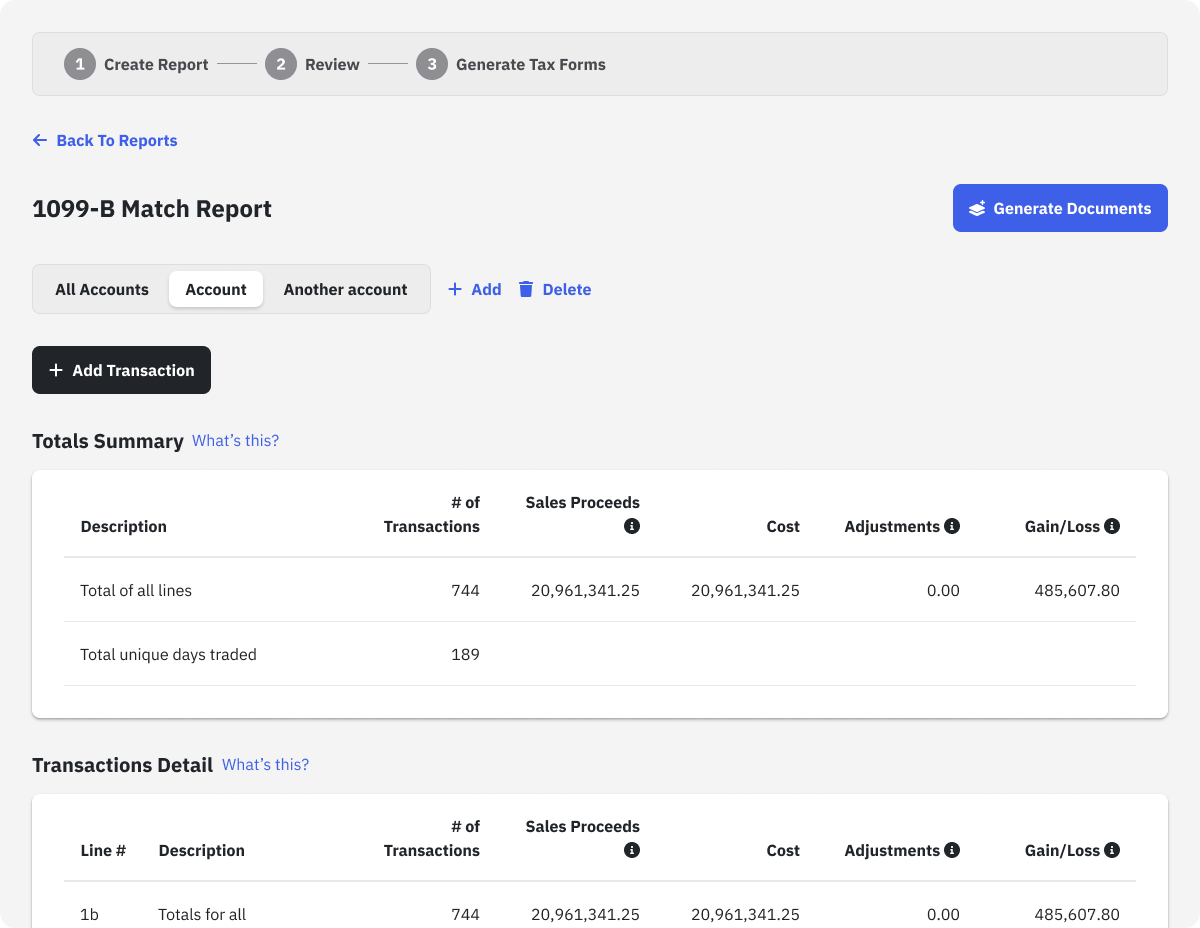

1099-B Match streamlines your trader tax reporting activity by extracting transaction history from your Form 1099-B PDF in seconds and generating IRS Form 8949 & Schedule D/IRS Form 4797. It simplifies tax reporting by seamlessly matching transactions, helping you optimize your tax position.

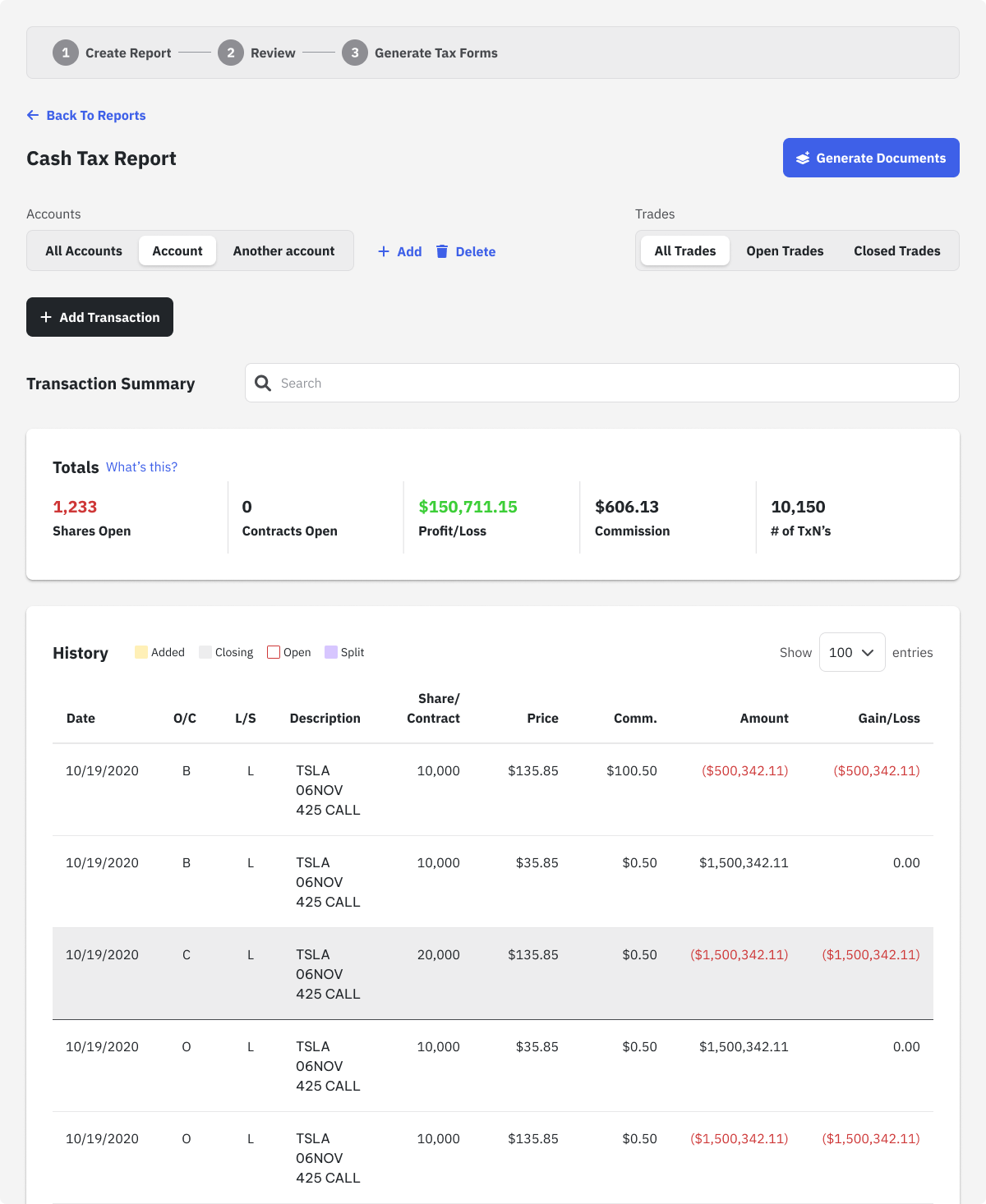

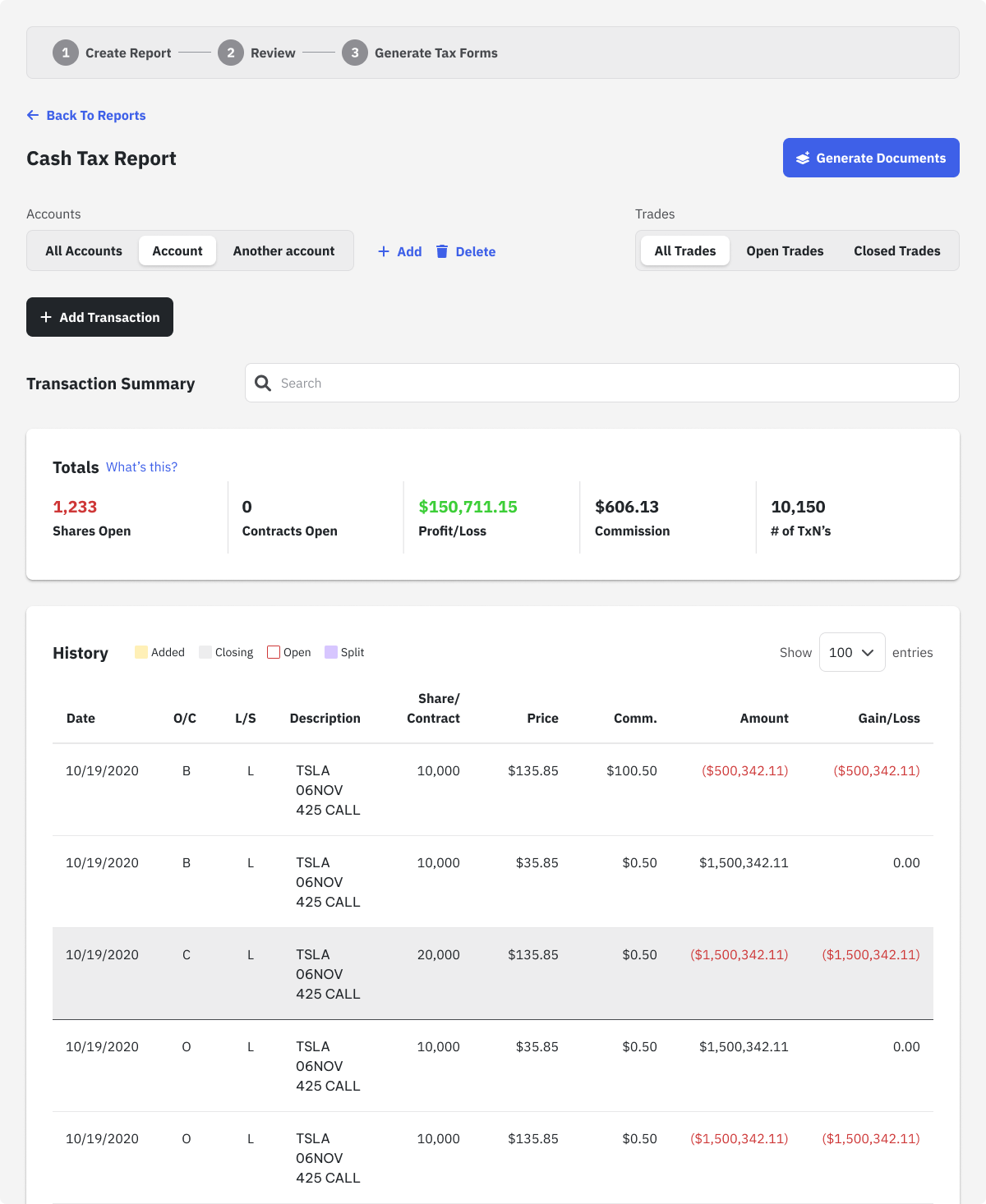

Audit My Broker empowers traders by performing an extremely accurate independent profit/loss calculation, flagging wash sales and more, ensuring you neither overpay nor underpay on your trader taxes.

Traders use our cloud-based app to automate trader tax reporting, manage wash sale effects, and streamline their tax filing. You should too.

Track, flag, and report wash sales effectively and avoid unnecessary tax

IRS-ready tax forms in minutes.

Easily incorporate cryptocurrency trading.

Find and fix errors so you don’t over/under pay in your trader taxes

Say goodbye to manual calculations.

Add as many brokerage accounts as you have.

Unparalleled Tax Reporting with 1099-B Match™ & Audit My Broker™

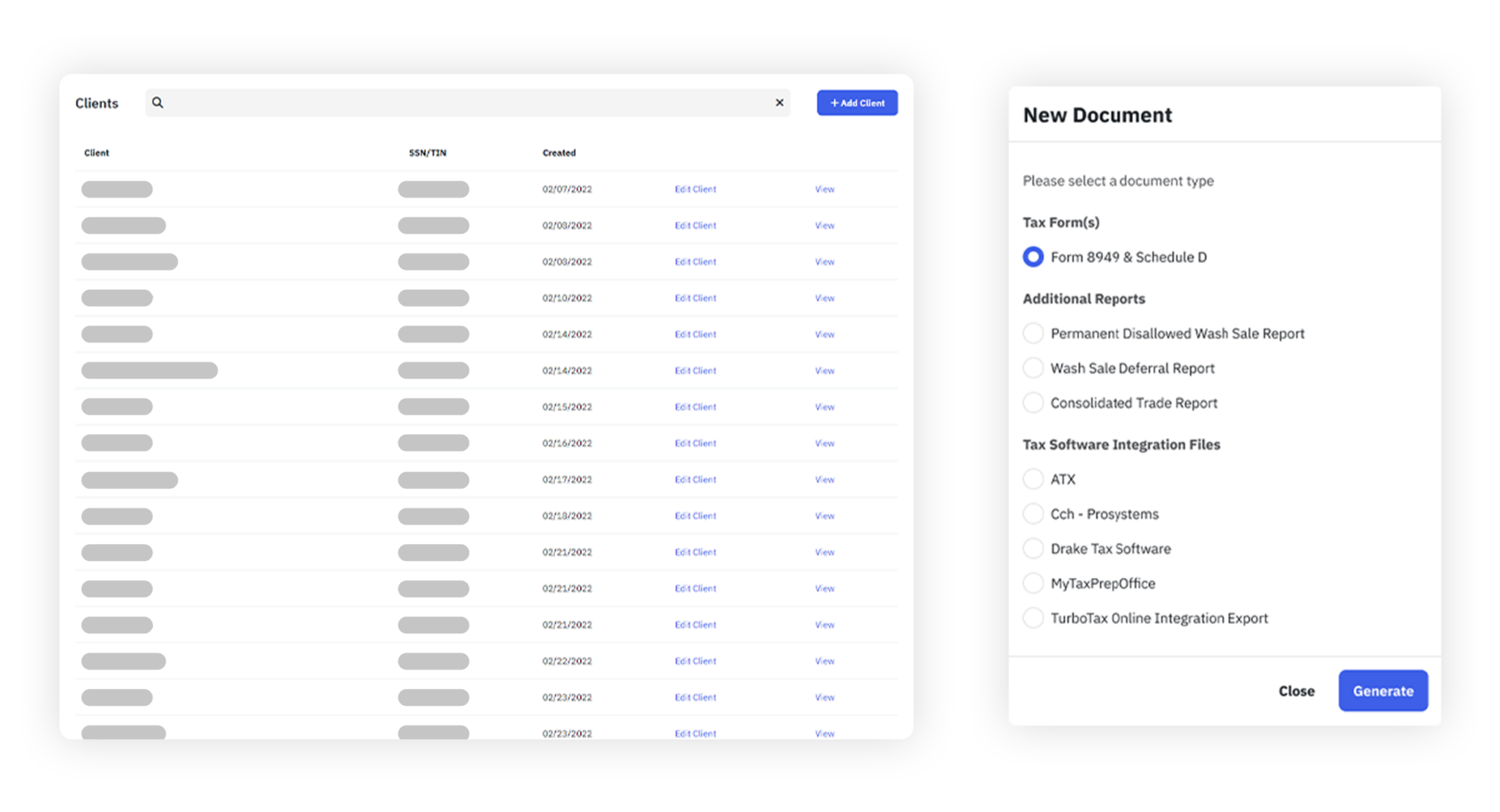

1099-B Match provides tax professionals with an efficient tool to reconcile clients’ trading transactions. This automation extracts the transaction history from the client’s Form 1099-B PDF in seconds, allows tax pro’s to enter missing transactions for unmatched transactions, and ensures precise reporting, saving time and reducing errors during tax season.

Audit My Broker is an invaluable asset for tax professionals, offering detailed insights into clients’ trades by performing an independent profit/loss calculation using transaction history, detecting discrepancies, flagging wash sales, and ensuring accurate and compliant tax filings.